What Are "Post-Closing Reserves?"

Posted by Tom Crimmins Realty, Ltd. on

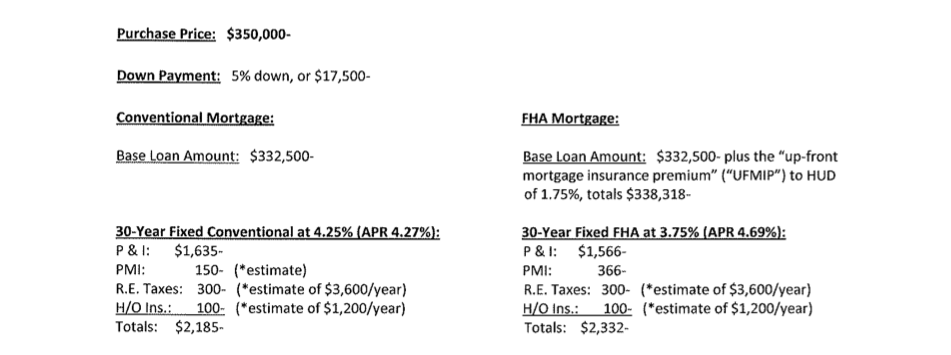

When applying for a mortgage, a lender may ask a borrower to show "post-closing reserves," depending on the mortgage program that the borrower is applying for (the funds must only be "shown," they are not taken by the lender). This is a very common underwriting guideline when applying for a "Conventional" mortgage on a 2-unit property. For example, if the proposed "PITI" (principal and interest, real estate taxes and homeowner's insurance) total $2,000 per month, then a lender wants to see a total of $12,000 in reserve, post-closing. These assets, that need to be shown, may be excess liquid funds in bank accounts, monies held in mutual funds or retirement funds (lenders generally let a borrower use 60% of a non-liquid retirement account when used for…

5407 Views, 0 Comments