BUSTED: 4 Myths About Buying Your First Home That Just Aren’t True

Posted by Front Desk on

There are a number of myths floating around regarding the home buying process. Such misconceptions have kept many would-be homeowners from realizing the personal and financial rewards of owning a property.

To clear things up, here are a few myths about buying your first home that simply aren't true.

Myth #1 - "It's Cheaper To Rent Instead Of Own"

If you buy a property that is within your budget and your mortgage terms allow you to make comfortable monthly payments, the cost of rent can often be higher than mortgage payments. Sure, there are other expenses associated with owning a property that you wouldn't be responsible for if you were renting, but one thing that many people forget is the fact that renting does not allow you to build equity. The…

2896 Views, 0 Comments

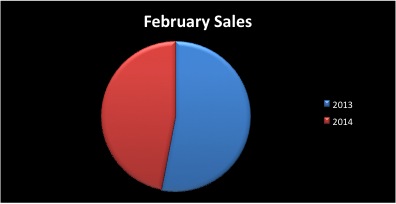

Last month, the Island had 209 sale sides with a monthly volume of $91,393,599. This differentiates to February 2013's 236 with a monthly volume of $91,187,983.

Last month, the Island had 209 sale sides with a monthly volume of $91,393,599. This differentiates to February 2013's 236 with a monthly volume of $91,187,983.